On Speculation in Crypto

Why Crypto’s history of speculative frenzy and hype cycles may not be a bad thing

Hello again!

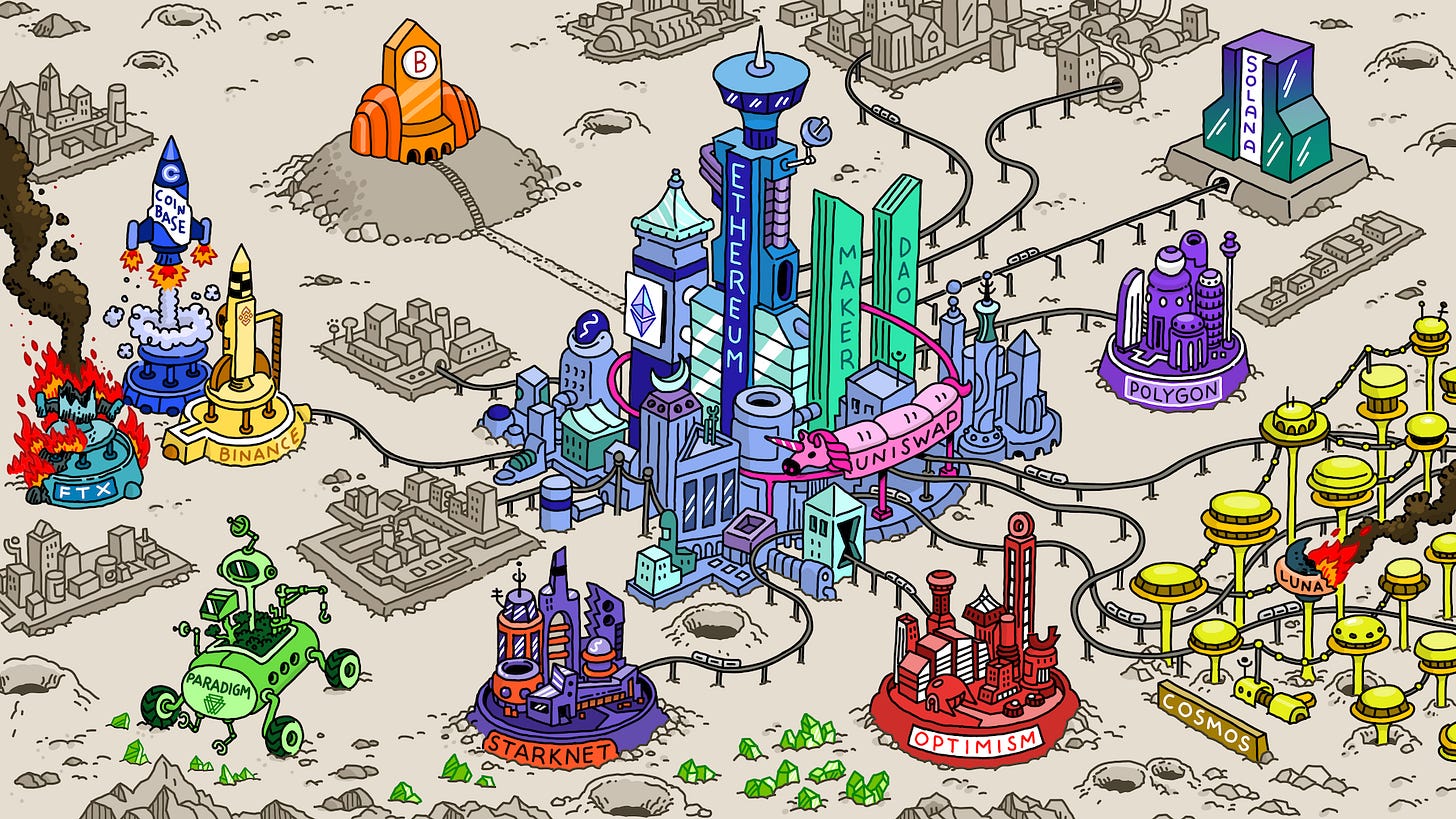

This piece was inspired by Matt Huang's The Casino on Mars, a literary masterpiece in which the author employs the metaphor of a new planet to symbolize the frenzied nature of the crypto market. So far, it tops my list of best reads this year, it creatively captures the speculatory nature of crypto. I strongly recommend that every builder out there should read it.

Speculation in crypto has become a hot topic of debate in the industry. This post will be frequently referenced in future editions of this newsletter. Do me a favor, spread the love by sharing this post.

Oh, and don't forget to hit the subscribe button as well. See you on the other side!

As with all financial markets, the crypto market has a long history of speculation. Crypto’s speculatory image and hype cycles have been the biggest criticism against it's existence. Many skeptics argue that the industry needs to move beyond speculative games, or better still, rid its lottery-like image, for it to scale to mainstream adoption. This piece summarizes my thoughts on whether all this speculation is necessary even as the space matures.

Historical Perspectives

Understanding speculation in the historical context of financial markets can help us navigate the current crypto landscape. Every investor should be a good student of history, think of it as a compass that steers you in the right direction.

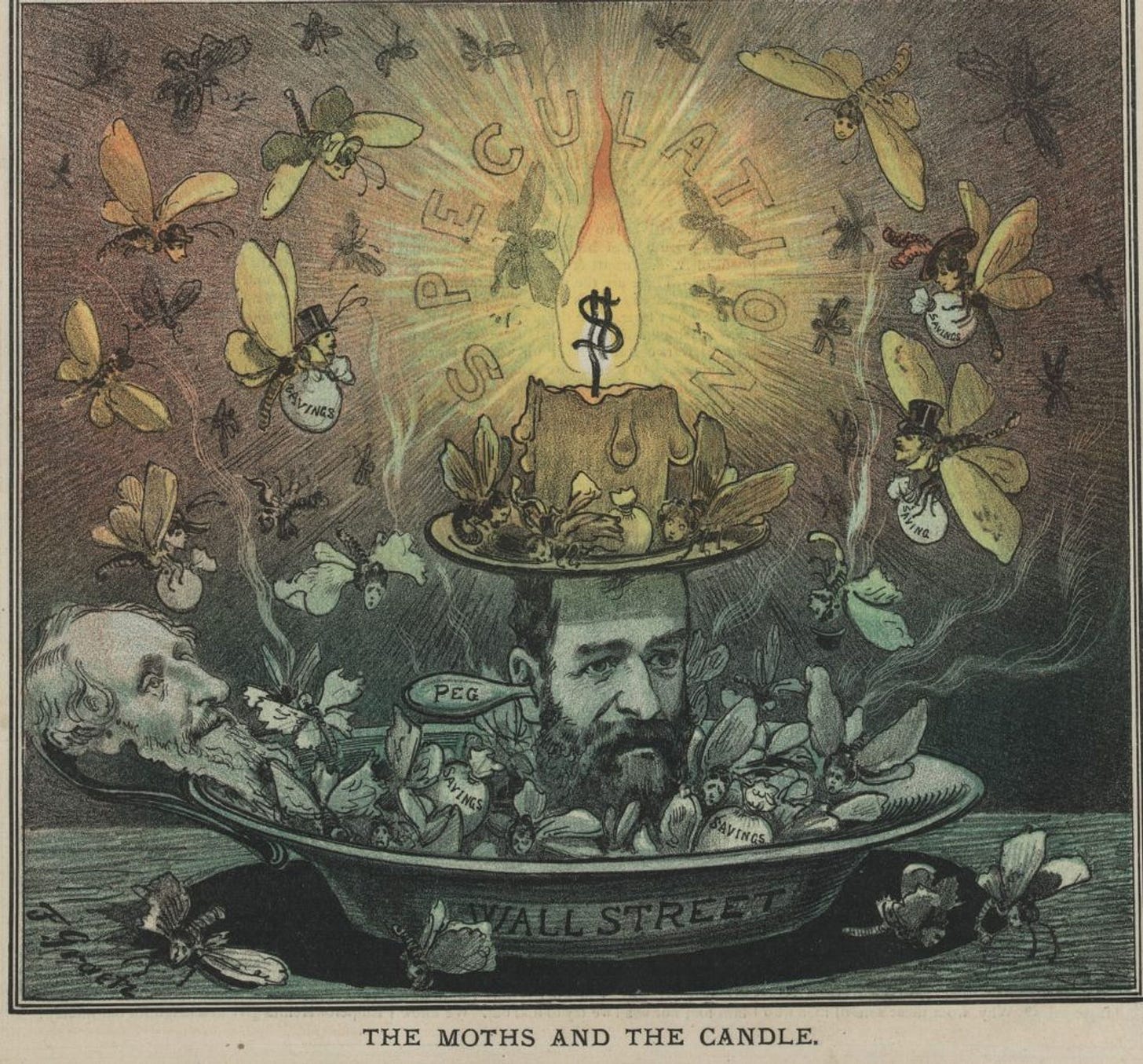

The history of financial markets is punctuated with speculative bubbles and manias. Since the earliest recorded history of stock markets, speculation has been a thing. Joseph De La Vega’s Confusion De Confusiones in 1688, describes the allure of speculation, and the psychology of the market participants on Amsterdam’s stock exchange in the 17th century1, he said:

“If it is of importance to spread a piece of news which has been invented by the speculators themselves, they have a letter written and [arrange to have] the letter dropped as if by chance at the right spot. The finder believes himself to possess a treasure, whereas he has really received a letter of Uriah which will lead him into ruin.” — Joseph de la Vega (1688)

History shows that speculation has benefited financial markets, providing the early liquidity for them to actually function and evolve into the mainstream asset markets they are today.

Speculation and Crypto

Speculation and crypto are deeply intertwined. In the past few years, the levels of speculative culture witnessed in crypto has been reminiscent of previous frenzies like the Dot Com bubble.

There's a negative perception of speculating as “degenerate gambling” that has lingered for centuries. As such, speculation and its associated manias are often dismissed and considered ludicrous by financial professionals and society at large. Much of Crypto’s skepticism can be attributed to this viewpoint, which is not entirely fair, given that speculative investments have historically been important catalysts in the diffusion of technological revolutions. From the internet to smartphones, railroads, telegraphs, computers, and more, the path from new innovations to mainstream adoption has often been riddled with speculation.

Bootstrapping a crypto protocol from scratch is hard, as most retail users are hesitant to make risky bets with their money, unless the value proposition is incredible. In John Joel's words: “Crypto’s original sin is in charging users.” Many crypto products have so-called “utility” on one side of the transaction but require speculation to fulfill the other side. Usually, the early-adopter horde are attracted by the allure of high risk-return bets. While it may be the “get rich quick” aspect of speculating on crypto that draws in the initial cohort of users, that experience with the protocol or product may lead to their developing a more serious and longer-term interest.

User retention for crypto products is more difficult compared with conventional tech apps. Since blockchains allows faster rails for the transfer of money, users tend to switch products frequently in search of more lucrative options. As such, to retain the initial cohort of users, protocols require a compelling product that offers better yields that users deem enticing enough. However, speculation serves the purpose of providing the initial liquidity boost for the protocol to effectively function, before network effect kicks in.2

Crypto's Dark Alley

As with all emergent technologies — chaos, is the way of life, and history offers some clues. The parallels between the Wild West or the early days of the internet, and crypto are striking. While crypto presents a frontier for innovation, akin to open or free markets, it also welcomes all kinds of participants, including the bad actors and the misbehaving ones.

Crypto has a dark alley of speculative manias that can be quite distasteful. There are way too many bad actors in crypto today — high-profile bankruptcies, busts, rug pulls, pump & dump schemes, blackhat hacks, Ponzi and pyramid schemes, the list goes on. Short-term speculative activities in a bid to to “time the market” often result in a zero-sum dynamic, where unsuspecting newbies are exploited by sophisticated traders. All of these account for crypto's regulatory fallout with the SEC.

Interestingly, the Cointelegraph incident coincided with when I was writing this piece (I couldn’t resist the temptation to chip it in). Earlier today, during routine coverage, Cointelegraph’s social media team posted a message on X (formerly Twitter) without prior editorial approval stating that the United States Securities and Exchange Commission had approved BlackRock’s iShares spot Bitcoin exchange-traded fund, or ETF. Apparently, this was false, a result of misinformation. The news lead originated from an unconfirmed screenshot posted by an X user who claimed it was from the Bloomberg Terminal. The result? Close to $60 million got liquidated due to the sudden price volatility.

If anything, this incident clearly shows that centuries later, investors are still falling prey to the same old trick. A pointer to the fact that one thing is always constant—human nature. Yes, technological advancements have evolved over the years, but people and their behaviors in each period are pretty much the same as they were centuries ago. Today, false news still sways the crypto market, causing volatile swing in the price of crypto assets. The same scenario that played out in the Amsterdam Stock Exchange in 1688. Different ages, same behavioral pattern.

However, amidst all these mayhem, it is worth remembering that equity markets were no different in the 19th century and early 20th century. The stock market endured long periods of speculation and fraudulent activity, before its transition into being a major pillar of modern finance. While the deafening noise of fleeting price movements may appear louder than signals of innovation, the crypto space is making considerable progress. For what it's worth, I believe crypto's net positives far outweighs the negatives.

Embracing Speculation

To set the record straight — Speculation is not an evil thing. In the context of crypto, It turns out that speculation has been productive. Financial speculation has been critical to the growth of crypto as a decentralized financial system. Some of the most prominent successful protocols strategically took advantage of financial speculation, and that will likely continue to be the case as the industry matures.

Many of the technological innovations that changed the the world today, were once considered impossible, insecure, and dangerous. Crypto is no different, it is an open frontier for innovation.

It is expected that the will crypto markets to follow a similar pattern, evolving far beyond this initial bootstrapping phase. Speculation is simply a historical pattern repeating itself, and a valid starting line for these new protocols to evolve into mainstream financial markets.

I'll see you next time, keep winning!

Enjoyed reading this? Consider sharing with a friend

https://investoramnesia.com/2022/07/17/history-matters/

https://en.wikipedia.org/wiki/Network_effect

Quite enlightening.